Mid Florida Debt Relief Specialists

If you are facing overwhelming merchant debt, utility bills, credit card debt, or are seeing the warning signs of financial hardship, don’t suffer alone!

Living with debt in Mid Florida can be stressful. Not only do you have the pressure of trying to make ends meet, but when things don’t come together, that’s when the calls start. Harassment by credit and debt collection agencies doesn’t make the process any easier.

We not only help you reduce your debt obligation, we help to reduce creditor calls through strategic partnerships we have made. We believe that everyone deserves to be treated with respect, especially those who are taking the steps necessary to regain their financial freedom.

Our process begins with a free, no-obligation evaluation of your debt. Our Certified Debt Specialists review your financial situation and discuss what options there are available to you for effective debt elimination, debt consolidation, or debt reduction.

Call Optimal Debt Solutions today at (561) 475-5788 for your Free Evaluation!

Dramatically Reduce Your Debt

Being in debt doesn’t mean that you are irresponsible or bad at “adulting”. There are many reasons why people of many ages can find themselves facing a huge stack of bills they can’t pay.

The average credit card debt in Mid Florida is higher than the national average, ranked 12th in the nation for highest average debt in 2018. Our debt settlement program helps you get out from under your bad debt.

Our debt specialists assist with negotiating and reducing your overall debt amount, including:

- Credit Card Debt

- Unsecured Loans

- Department Store Cards

- Medical Bills

- Collections Accounts

- Payday Loans

- Repossessions

When facing debt collection, you need a dedicated expert on your side. At Optimal Debt Solutions, we review your personal financial situation free of charge. We look at the debt amount, your income and ability to pay, and discuss the best options for negotiating your debt to a manageable level.

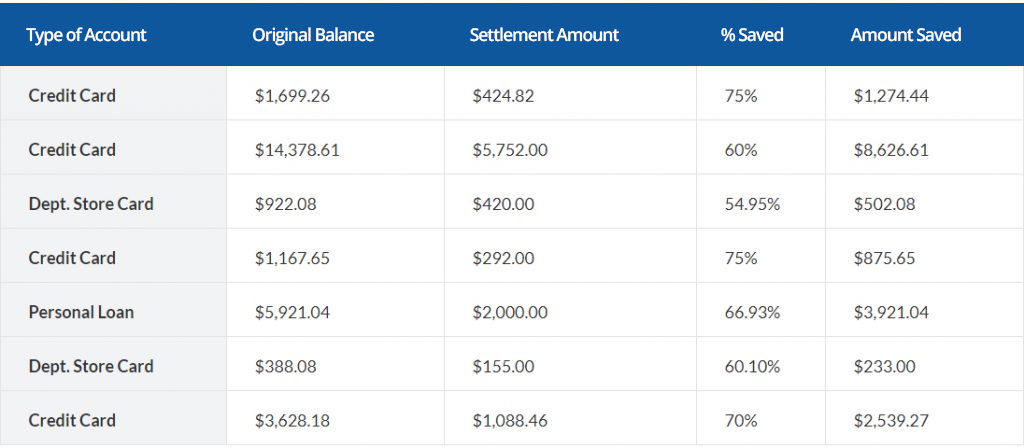

We help you dramatically reduce your debt by up to 60% or more through strategic debt negotiations to achieve the best settlement opportunities for you.

Debt Settlement Vs. Debt Consolidation

Not all debt management companies and debt relief programs are created equal. There are several different solutions for managing debt. Our experience and research shows that the most effective method for reducing debt is through debt settlement.

Credit debt consolidation in Mid Florida and credit counseling can help to dramatically reduce your payments versus a standard repayment plan for most debts. Credit card consolidation programs consist of taking various debt sources and combining them into a new loan with better terms, such as a reduced interest rate. The funds from the new loan will then be used to pay the previous credit accounts. However, debt consolidation loans only leave you with a new loan and new obligation, they do not negotiate better terms.

A credit counseling organization or credit counselor works with you by providing financial education to Mid Florida, FL residents through a debt relief program, such as helping you understand how you can budget your money to better meet your payment obligations.

However, with debt settlement, you can reduce your amount owed to creditors by up to 50%, as well as reduce the quantity and amount of individual payments and shorten the length of time before your debt is repaid compared to other debt relief options. This means that debt settlement both saves money and gets you out of debt faster. The sooner your creditors have been paid, the faster you can get back on track to living your life with reasonable expenses.

Effective Debt Relief Negotiation

We have helped over 180,000 clients regain control over their finances, and we look forward to adding you to our success stories. We understand that your personal financial situation is unique. That is why our program is personalized to you, your debts, and what monthly payments you are able to make.

Our fees are included in your regular program deposits, so even with the cost of negotiation factored in, you may still see a substantial reduction in both monthly and total payments. We are dedicated to providing a 5-star experience to all of our clients, and will deliver a solution that meets your needs and lifestyle.

Mid Florida Debt Relief Company

Call Optimal Debt Solutions today at (561) 475-5788 for your Free Evaluation!